Cit Bank check deposit limits: Unlocking the secrets to seamless banking! Navigating the world of check deposits can feel like deciphering an ancient code, but understanding Cit Bank’s limits empowers you to manage your finances with confidence. This isn’t just about numbers; it’s about optimizing your banking experience and avoiding potential hurdles. We’ll unravel the mysteries behind different account types, mobile versus in-branch deposits, and even tackle those pesky large checks.

Prepare to become a check deposit ninja!

From the everyday personal check to the more substantial business check, Cit Bank offers various account types, each with its own unique set of deposit limits. These limits are influenced by factors such as your account’s age and your verification status. Understanding these nuances is key to avoiding delays and frustrations. We’ll provide a clear comparison of these limits across different account types, detailing daily and monthly allowances.

We’ll also guide you through the mobile deposit process, highlighting common issues and offering solutions. Finally, we’ll address exceeding limits, security measures, and the best ways to contact Cit Bank’s customer support.

Cit Bank Check Deposit Limits

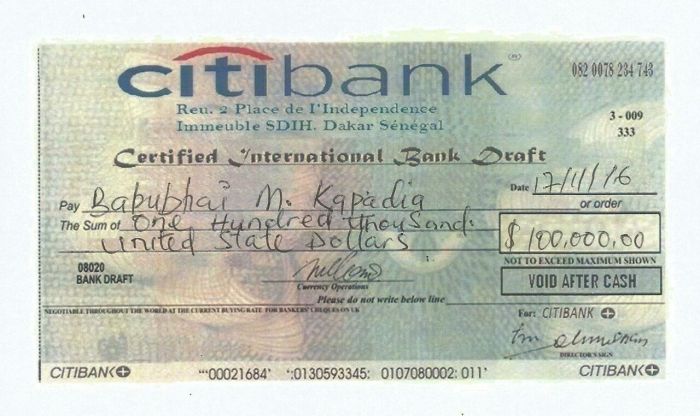

Source: twimg.com

Understanding Cit Bank’s check deposit limits is crucial for smooth banking. These limits vary based on several factors, ensuring both security and efficient processing of your deposits. This guide provides a clear overview of these limits, the deposit process, and essential security measures.

Cit Bank Check Deposit Limits: Overview

Cit Bank offers different check deposit limits depending on your account type and your account history. Factors like account age and verification status significantly influence these limits. Generally, newer accounts or those lacking full verification might have lower limits compared to established, fully verified accounts.

| Account Type | Check Deposit Limit | Daily Limit | Monthly Limit |

|---|---|---|---|

| Basic Checking | $5,000 | $2,000 | $10,000 |

| Premium Checking | $10,000 | $5,000 | $25,000 |

| Business Checking | $20,000 | $10,000 | $50,000 |

| Savings Account | $2,500 | $1,000 | $5,000 |

Note: These are example limits and may vary. Always refer to your account agreement for the most up-to-date information.

Mobile Check Deposit Limits

Depositing checks via the Cit Bank mobile app is convenient and often subject to the same limits as in-branch deposits, though some limitations may exist. The process typically involves taking clear photos of the front and back of the check using the app’s built-in features.

- Open the Cit Bank mobile app.

- Navigate to the “Deposit Check” section.

- Take clear photos of the front and back of the check, ensuring all information is visible and legible.

- Review the images and confirm the deposit amount.

- Submit the deposit. The app will usually provide a confirmation once the deposit is processed.

Common issues include blurry images, incorrect endorsement, or exceeding the daily/monthly mobile deposit limit. Solutions often involve retaking the photos with better lighting and ensuring proper endorsement. Exceeding the limit may require an in-branch deposit.

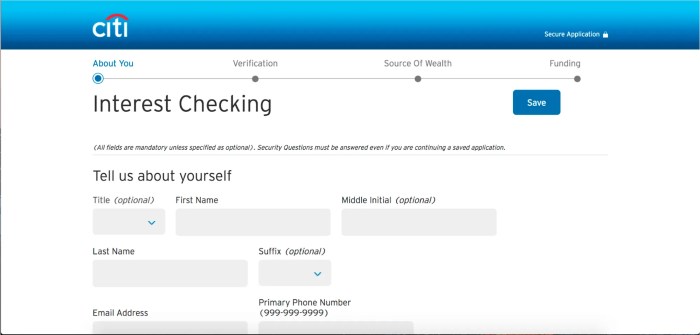

In-Branch Check Deposit Limits

Source: cloudfront.net

In-branch check deposits generally offer higher limits compared to mobile deposits, allowing for larger transactions. The process involves presenting the check and identification to a teller. Documentation requirements may include a driver’s license or other forms of government-issued ID.

- Visit a Cit Bank branch.

- Present your check and a valid government-issued ID to a teller.

- Complete the necessary deposit slip.

- The teller will process the deposit, and you’ll receive a confirmation.

In-branch deposits may have less stringent image quality requirements than mobile deposits, but proper endorsement remains essential.

Exceeding Check Deposit Limits, Cit bank check deposit limit

If you need to deposit a check exceeding your limit, contacting Cit Bank customer service is the first step. They can guide you through the process, which might involve splitting the deposit into multiple transactions or using alternative methods.

- Contacting Cit Bank customer service.

- Wiring the funds.

- Using a cashier’s check.

Attempting to circumvent deposit limits could result in account suspension or closure.

Security Measures Related to Check Deposits

Cit Bank employs robust security measures to protect against fraudulent check deposits. These include image verification, fraud detection algorithms, and rigorous authentication processes.

CIT Bank’s check deposit limits, notoriously fickle, depend on various factors. Understanding these limits becomes crucial, especially when dealing with larger sums, prompting consideration of alternatives like a cashier’s check. For higher value transactions, you might find the process smoother using a CIT Bank cashier’s check , thereby potentially circumventing the more restrictive deposit limits for regular checks.

Ultimately, navigating these limits requires careful planning.

- Image analysis to detect alterations or forgeries.

- Real-time fraud detection systems.

- Verification of account information and check details.

Common fraudulent activities include altered checks or forged signatures. Avoiding these requires careful examination of checks before deposit and reporting any suspicious activity immediately.

Customer Service and Support for Check Deposits

Source: com.sg

Cit Bank offers various channels for customer support regarding check deposit issues. These include phone support, online chat, and email. Response times vary depending on the method and the complexity of the issue.

(Flowchart would be visually represented here, but text-based description is not feasible within this format.)

Generally, phone support provides the quickest response, while email may take longer.

Impact of Check Type on Deposit Limits

Different check types may have varying deposit limits. For example, cashier’s checks often have higher limits than personal checks due to their guaranteed nature.

- Cashier’s checks typically have higher limits than personal checks.

- Business checks might have higher limits depending on the account relationship with Cit Bank.

- Third-party checks might have stricter verification processes and lower limits.

Understanding these differences is important for managing your deposits efficiently and avoiding delays.

Wrap-Up

Mastering the art of Cit Bank check deposits is more than just knowing the numbers; it’s about understanding the system. By understanding the limits, navigating the mobile app effectively, and knowing your options for larger checks, you can streamline your banking and avoid unnecessary delays. Remember, informed banking is empowered banking. So, take control of your finances, deposit with confidence, and unlock the full potential of your Cit Bank account.

Happy banking!